2021 FICA Tax Rates

Por um escritor misterioso

Descrição

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

How rising inequality frays the social safety net

Use the 2021 FICA tax rates, shown, to answer the following question. If a taxpayer is self-employed and

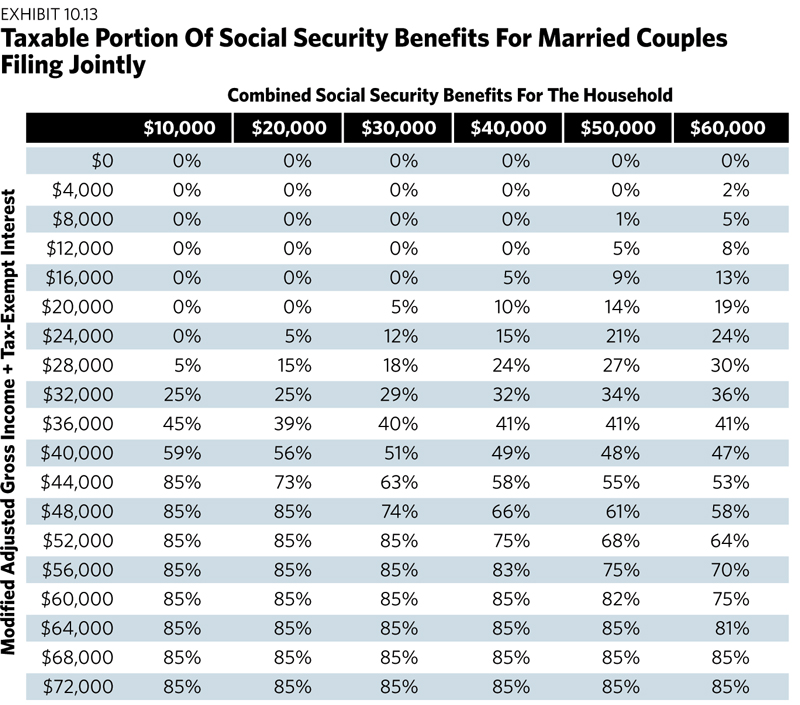

Avoiding The Social Security Tax Torpedo

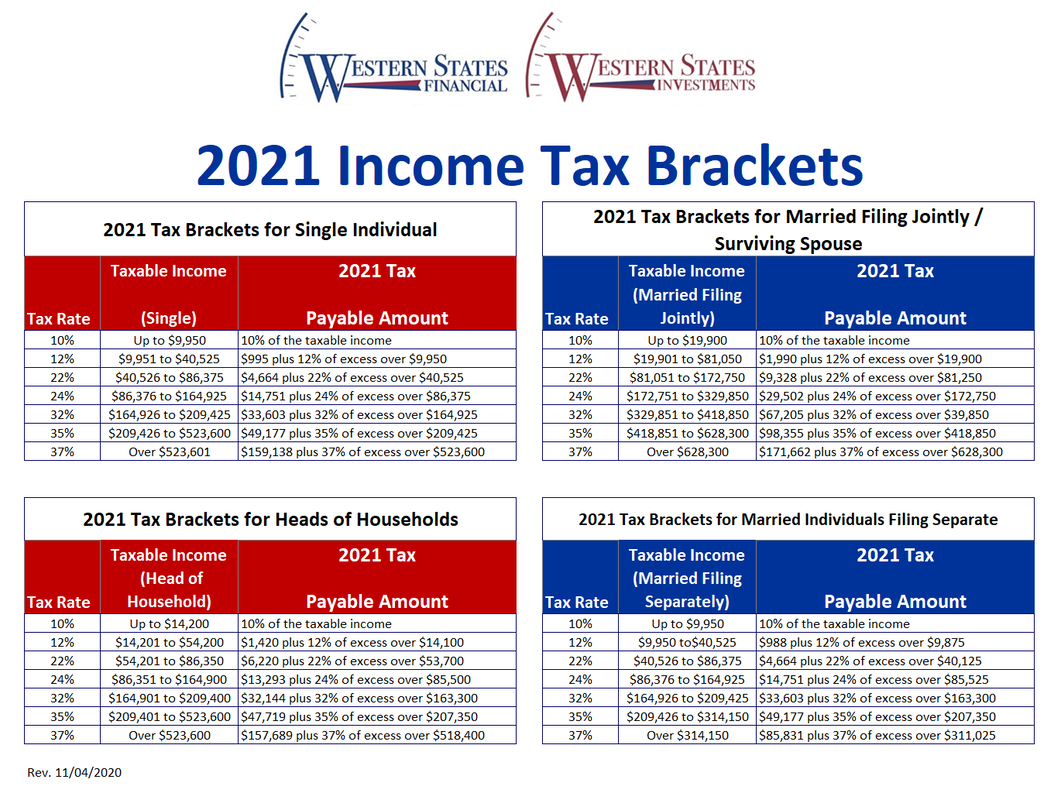

2021 Federal Tax Brackets, Tax Rates & Retirement Plans - Western States Financial & Western States Investments - Corona , CA John Weyhgandt, Financial Coach & Advisor

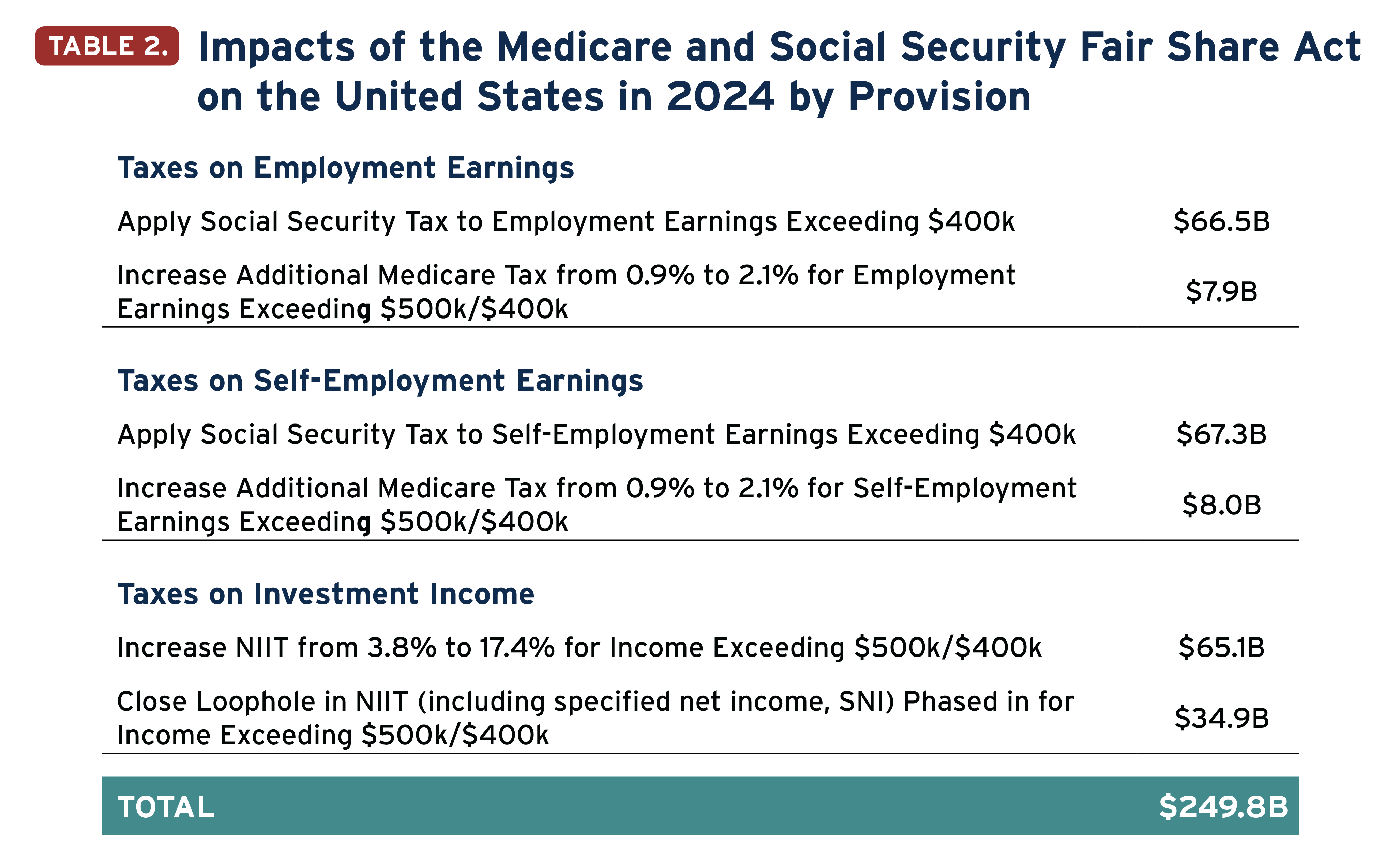

Distributional Effects of Raising the Social Security Payroll Tax

Inflation Spikes Social Security Checks for 2022 - Baker Holtz

2021 Wage Base Rises for Social Security Payroll Taxes

Fair Share Act' Would Strengthen Medicare and Social Security Taxes – ITEP

Will I Have to Pay Taxes on My Social Security Income?

de

por adulto (o preço varia de acordo com o tamanho do grupo)