FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Por um escritor misterioso

Descrição

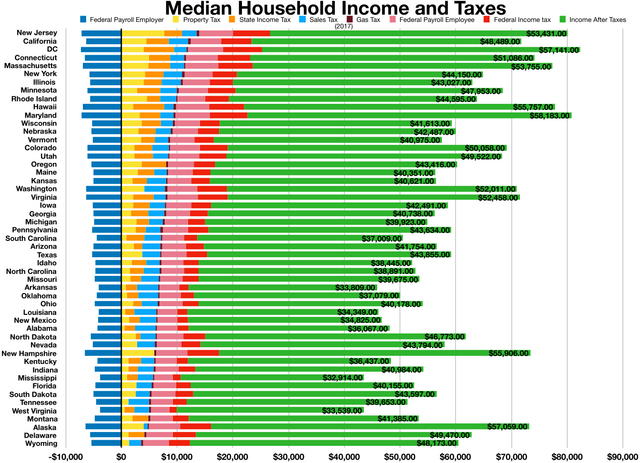

Employers and employees must pay FICA taxes to contribute to social security and medicare. What you need to know.

IRS Form 941: How to File Quarterly Tax Returns - NerdWallet

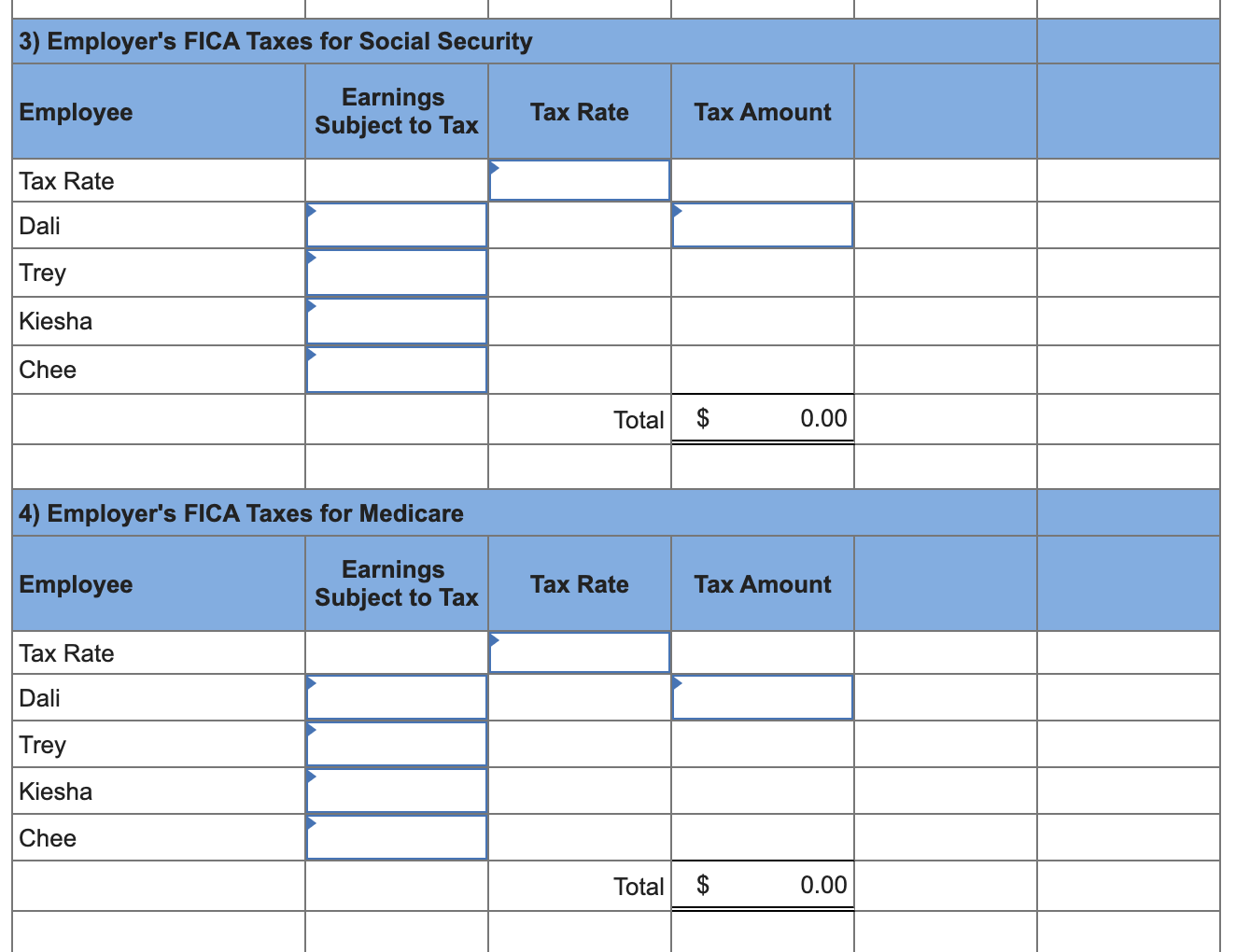

Solved Paloma Company has four employees. FICA Social

Federal Insurance Contributions Act - Wikipedia

Payroll Deductions: The Ultimate Guide for Business Owners - NerdWallet

Self-Employment Taxes and SECA: Complete Guide

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Qualified Business Income Deduction (QBI): What It Is - NerdWallet

How to Start a Business in 15 Steps - NerdWallet

Incentive Stock Options (ISOs): Taxes and Benefits - NerdWallet

Federal Insurance Contributions Act: FICA - FasterCapital

Smart Money Podcast: Retirement Planning Guide: Estate Planning, Social Security, Long-Term Care and Medicare Explained - NerdWallet

Self-Employed Retirement Plans: Know Your Options - NerdWallet

Employment Practices Liability Insurance - NerdWallet

Zelle Taxes: Why This Payment App Is Different - NerdWallet

de

por adulto (o preço varia de acordo com o tamanho do grupo)