How derivative traders can make the most of increased volatility

Por um escritor misterioso

Descrição

It has become routine for Nifty to go up or down by 300 points —around 1,000 points on the Sensex—daily. Though heightened volatility unnerves normal investors, it spells opportunities for derivative traders.

Volatility Insights: Evaluating the Market Impact of SPX 0DTE Options

Volatility arbitrage: Taming Market Volatility with Arbitrage

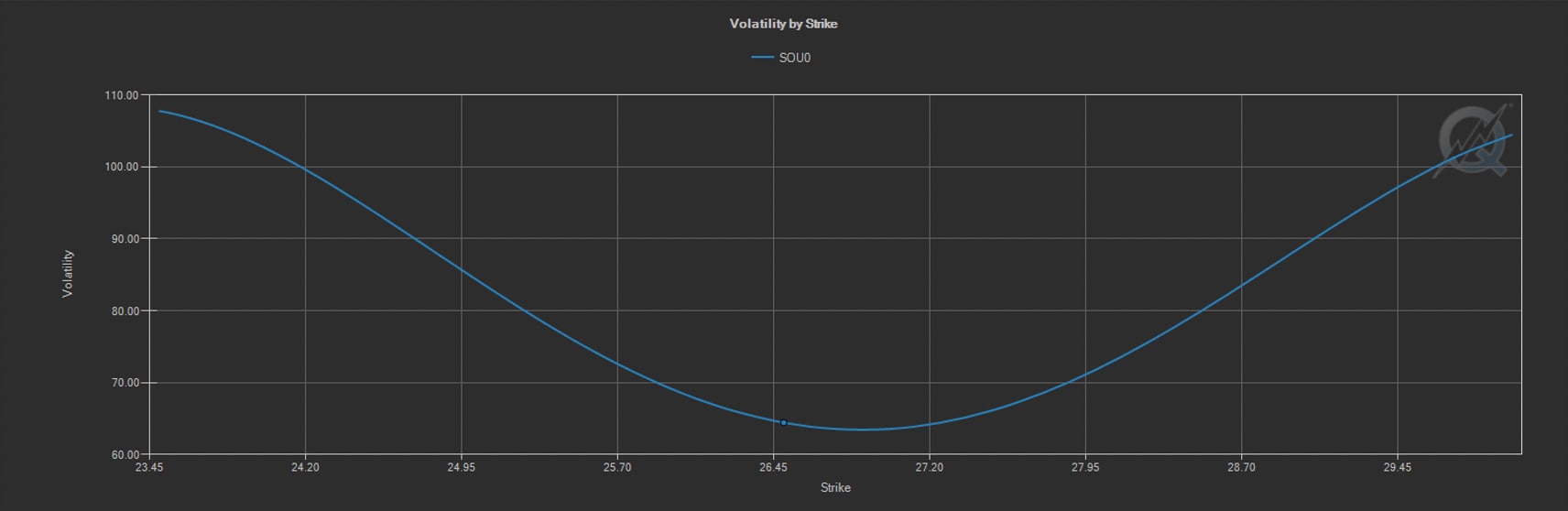

Implied Volatility - CME Group

Volatility: Definition and Meaning in Global Markets

What is Volatility in Forex? - Forex Volatility Explained / Axi

Best Leveraged ETFs: A High-Risk, High-Reward Bet On Short-Term

Derivatives: Understanding the Role of Derivatives in the Futures

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility: Buy Low and Sell High

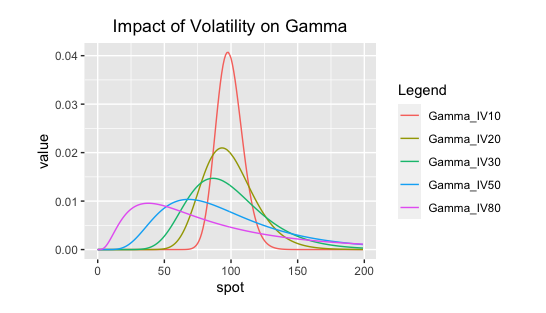

Chapter 5 The Greeks The Derivatives Academy

OTC Derivatives

The Importance of Liquidity and Volatility For Traders

:max_bytes(150000):strip_icc()/derivative_final-fbb671f41d73438a96a5b8a8110145f0.png)

Derivatives: Types, Considerations, and Pros and Cons

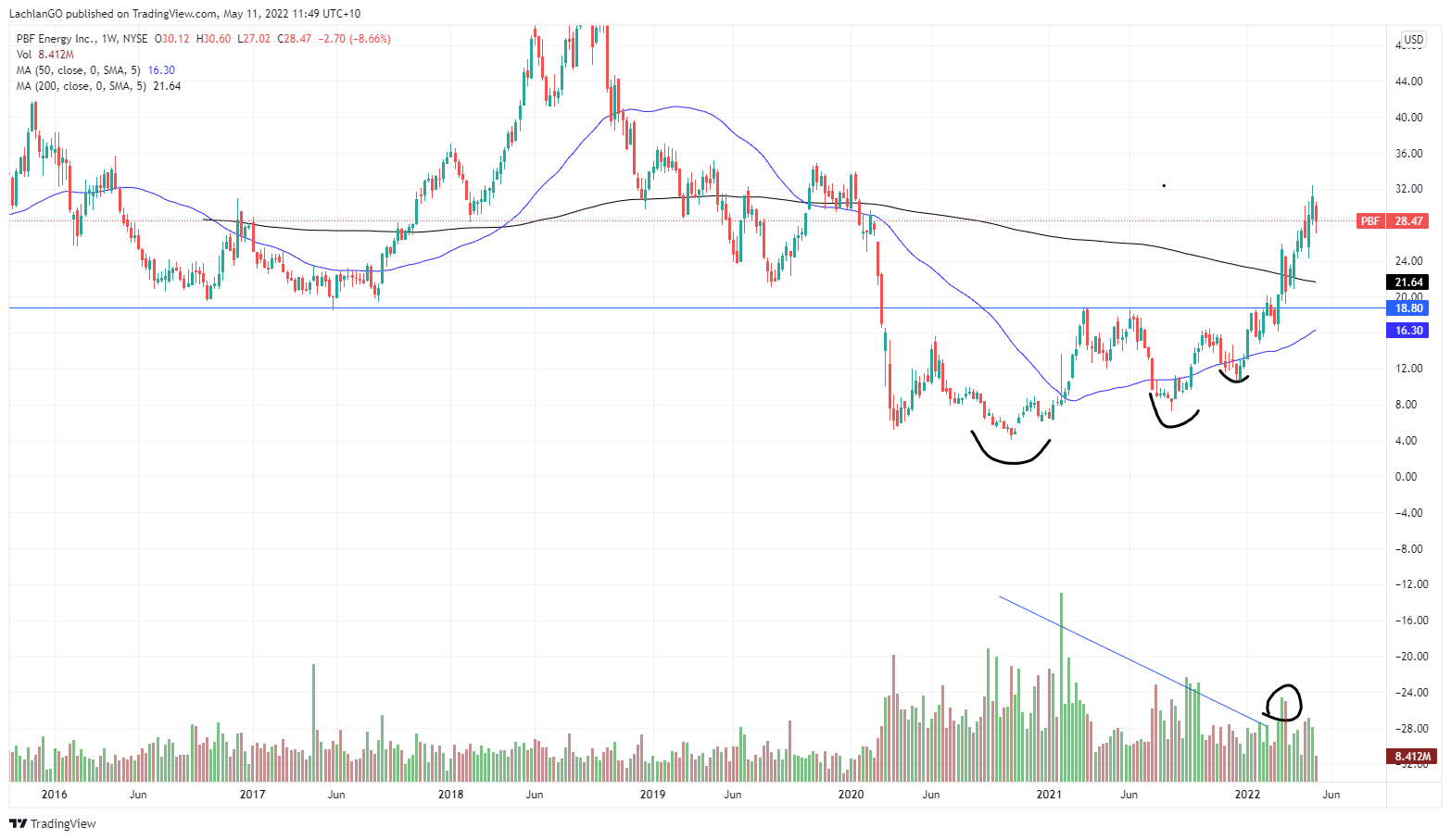

How to trade the Volatility Contraction Pattern - GO Markets

de

por adulto (o preço varia de acordo com o tamanho do grupo)